2 April, 2024 | Cryptocurrency Blog

In the ever-volatile landscape of cryptocurrency, investors and enthusiasts are constantly on the lookout for stability amidst the tumultuous waves of market fluctuations. A type of cryptocurrency designed to offer the best of both worlds: the instant processing and security of payments of cryptocurrencies, and the stable valuations of fiat currencies. But does this make stablecoins the safe haven of the crypto world? Let’s delve deeper.

What Are Stablecoins?

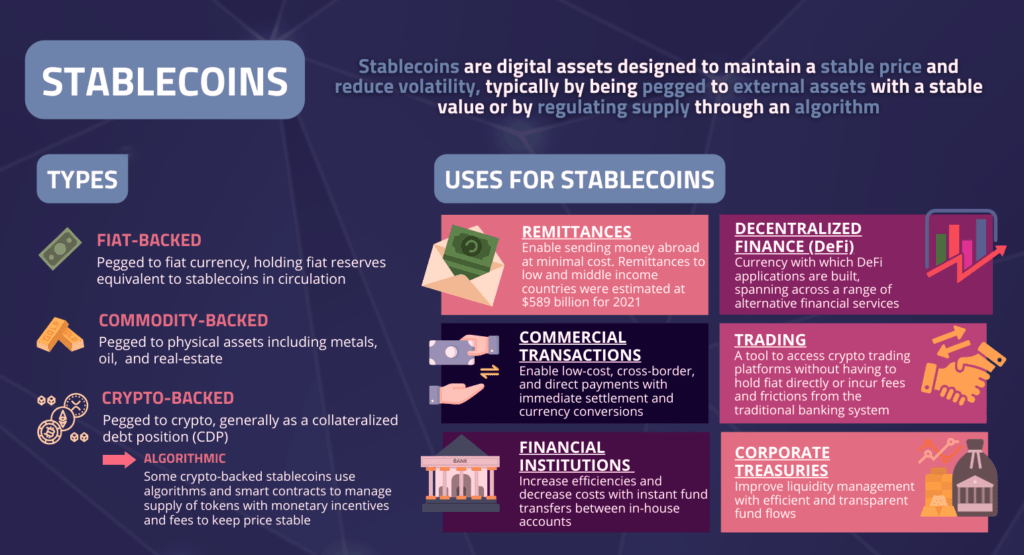

At their core, stablecoins are cryptocurrencies that are pegged to a stable asset, like the US dollar, other fiat currencies, or even commodities like gold. This pegging mechanism aims to reduce volatility, making stablecoins an attractive option for daily transactions, remittances, and as a safe harbor during periods of significant crypto market volatility.

The Promise of Stability

The primary allure of stablecoins lies in their promise of stability. In a market where double-digit price swings within a single day are not uncommon, the relative calm offered by stablecoins is indeed appealing. They allow for the benefits of digital, blockchain-based transactions without the rollercoaster ride associated with traditional cryptocurrencies like Bitcoin or Ethereum.

Safe Haven in Turbulent Times

During times of market turbulence, investors often flock to what they perceive as safe assets. In the traditional financial world, this typically means gold or government bonds. In the crypto universe, play a similar role. When the crypto market is bearish, investors may convert their assets into these coin to preserve their value, waiting for the right moment to re-enter the market.

Use Cases and Advantages

Beyond serving as a digital safe haven, stablecoins have practical use cases that enhance their appeal. They make it easier to transact across borders without worrying about exchange rate fluctuations, offer a stable medium for digital contracts, and facilitate easier access to cryptocurrencies for newcomers wary of volatility.

Moreover, these are pivotal in the burgeoning field of decentralized finance (DeFi), where they provide the stability needed for lending, borrowing, and earning interest on digital assets without the traditional banking system.

The Risks and Criticisms

However, it’s essential to recognize that stablecoins are not without their risks and criticisms. The stability of a stablecoin is heavily dependent on the integrity and management of its reserves—the assets to which the stablecoin is pegged. Mismanagement, lack of transparency, or regulatory issues with these reserves can undermine the stability of the stablecoin, potentially leading to a loss of trust and value.

Furthermore, regulatory scrutiny is a significant concern. Governments and financial authorities worldwide are still grappling with how to regulate to prevent money laundering, ensure financial stability, and protect consumers without stifolding innovation.

Are Stablecoins Truly the Safe Haven?

To answer this question, one must consider both the unique benefits and the potential risks associated with stablecoins. They undoubtedly offer a semblance of stability and a refuge during periods of significant volatility in the broader crypto market. Their utility in facilitating transactions, both within the crypto ecosystem and in the traditional financial system, cannot be understated.

Yet, like any investment, they are not entirely risk-free. The assurance of stability is as good as the management of the underlying assets and the regulatory environment in which they operate. Investors and users must perform due diligence, staying informed about the it’s backing, governance, and compliance with regulations.

The Future of Stablecoins

Looking ahead, the trajectory of stablecoins appears promising but will be closely tied to regulatory developments and the evolution of the crypto market at large. As the technology matures and more people become comfortable with digital currencies, It could play a crucial role in the broader adoption of cryptocurrency, acting as a bridge between the traditional and digital finance worlds.

Conclusion

while stablecoins offer a relatively safer harbour within the crypto world, they are not entirely devoid of risk. Their future success and stability will hinge on transparent management practices, regulatory clarity, and the continued faith of the crypto community. For now, they remain a fascinating and vital part of the cryptocurrency ecosystem, providing a much-needed anchor in the digital currency storm.

Hopefully, you have enjoyed today’s article. Thanks for reading! Have a fantastic day! Live from the Cryptologist For You Floor.